In a recent mandate by the Nigeria Interbank Settlement System Plc (NIBSS), Nigerian banks have been instructed to disengage all non-deposit-taking financial entities from their Nigerian Interbank Payment (NIP) outward fund transfer channels.

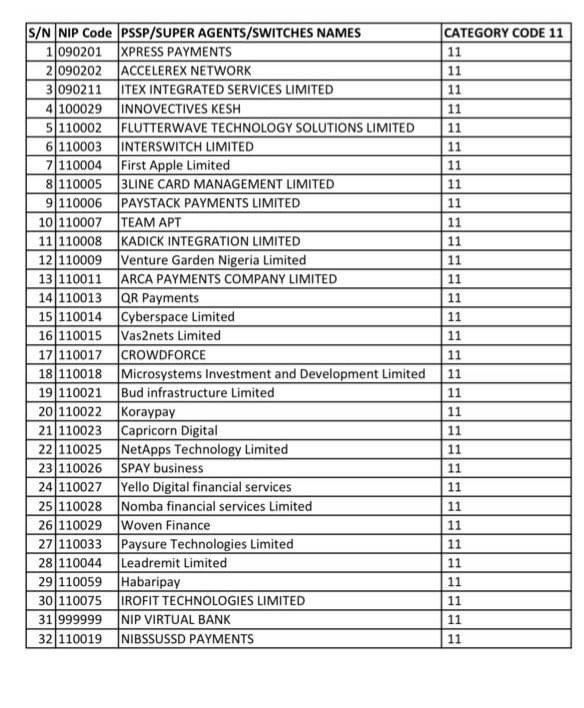

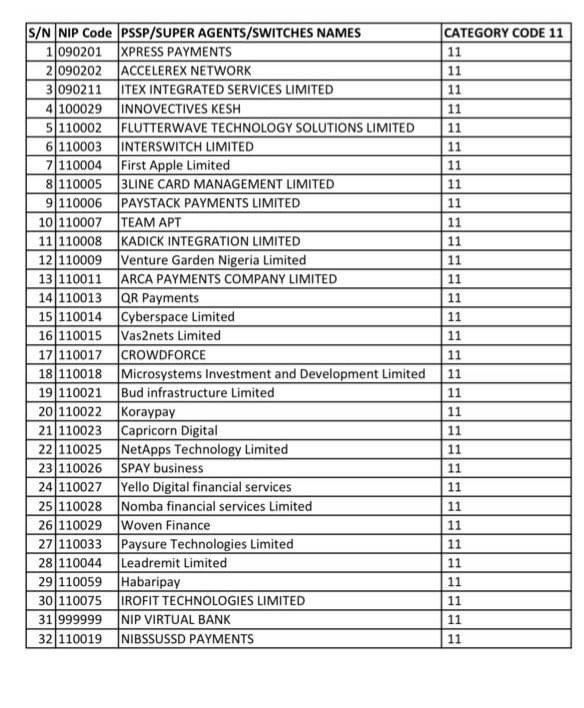

These institutions, defined in the directive as “Switching Companies (Switches), Payment Solution Service Providers (PSSPs), and Super Agents (SA),” are integral to the nation’s digital financial ecosystem, offering a range of transaction services across various platforms, including USSD, mobile banking applications, Point of Sale (POS) systems, Automated Teller Machines (ATMs), and online banking services.

An earlier version of this story mentioned certain banks concerning the NIBSS press release. However, further review has clarified that none of the banks initially referenced are impacted.

The circular from NIBSS states:

“Listing non-deposit taking financial institutions such as Switching Companies (Switches), Payment Solution Service Providers (PSSPs) and Super Agents (SA) as beneficiary institutions on your NIP funds transfer channels contravenes the CBN Guidelines on Electronic Payment of Salaries, Pensions, Suppliers and Taxes in Nigeria dated February 2014.”

Further emphasizing the extent of the directive, the circular clarifies: “Switches, PSSPs and SAs may process outward transfers as inflows to Banks but are not to receive inflows as their licenses do not permit them to hold customers’ funds.”

What this means

This move underscores the regulatory framework within which Nigerian Fintechs operate and the compliance expected regarding their licensed financial activities.

The policy enforcement will result in the removal of Fintech platforms without banking licenses from the fund transfer channels of banks.

They will, however, retain the capacity to facilitate “outward transfers as inflows to Banks,” but will no longer receive inflows.

In light of these developments, it is anticipated that the affected financial technology companies will explore the necessary steps to obtain banking licenses that will allow them to hold and manage customer funds legally.

This regulatory requirement is likely to have a notable impact on small business owners, who frequently utilize these platforms for their financial transactions.

With the enforcement of this directive, the expectation is set that “Fintech companies will expedite action in obtaining banking licenses,” a move seen as essential to sustain their operations and support their customer base.

More details as it unfolds........